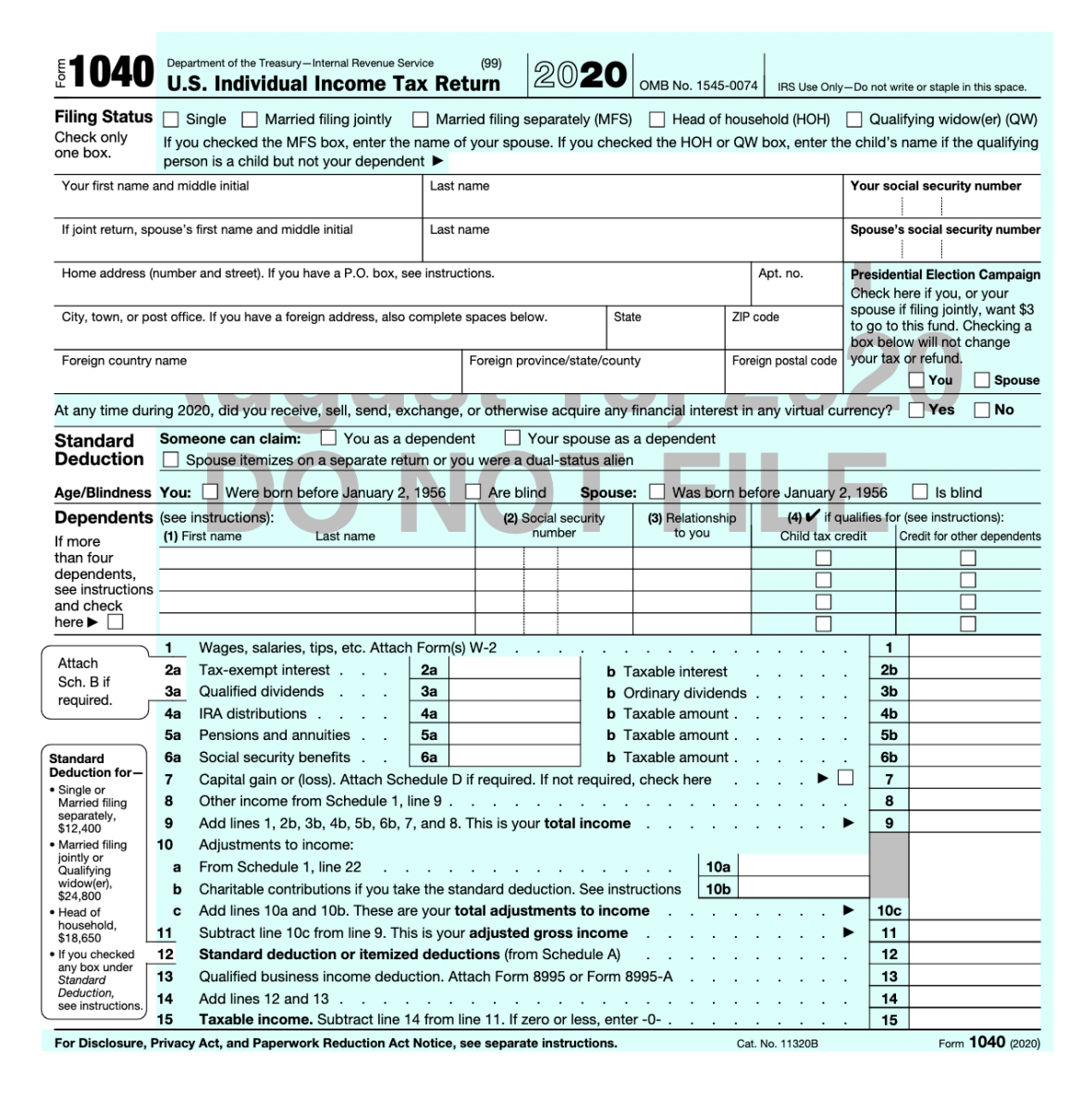

Student Loan Discharged Due to Closure of a For-Profit School – California law allows an income exclusion for an eligible individual who is granted a discharge of any student loan under specified conditions. For more information, see specific line instructions in Part I, Section B, line 2a and Section C, line 18a. Federal Deposit Insurance Corporation (FDIC) PremiumsĪlimony – California law does not conform to changes made by the TCJA to federal law regarding alimony and separate maintenance payments that are not deductible by the payor spouse, and are not includable in the income of the receiving spouse, if made under any divorce or separation agreement executed after December 31, 2018, or executed on or before December 31, 2018, and modified after that date (if the modification expressly provides that the amendments apply).Student loan discharged on account of death or disability.

California Revenue and Taxation Code (R&TC) does not conform to all of the changes. Loophole Closure and Small Business and Working Families Tax Relief Act of 2019 – The Tax Cuts and Jobs Act (TCJA) signed into law on December 22, 2017, made changes to the Internal Revenue Code (IRC). References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

0 kommentar(er)

0 kommentar(er)